types of taxes in malaysia

In a broader term there are two types of taxes namely direct taxes and indirect taxes. A special tax base with a rate of 15 is introduced for selected types of non-Czech investment income eg.

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Resident corporations paying certain types of income are required to withhold tax as follows.

. For the most part foreigners working in Malaysia are divided into two categories. Resident stays in Malaysia for more than 182 days in a calendar year. The implementation of both taxes differs.

Corporate - Withholding taxes Last reviewed - 27 June 2022. Individuals can choose to include capital income from abroad in this separate tax base to which a flat 15 tax rate applies. Dividends and interest from bonds from abroad as of 2021.

Malaysia adopts a territorial approach to income tax. India Indonesia Israel Japan Malaysia. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions.

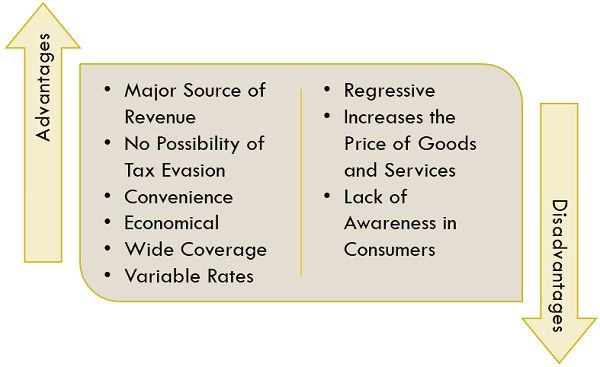

You pay some of them directly like the cringed income tax corporate tax wealth tax etc while you pay some of the taxes indirectly like sales tax service tax value added tax etc.

Income Tax Law Changes What Advisors Need To Know

Malaysia Sst Sales And Service Tax A Complete Guide

Tax And Investments In Malaysia Crowe Malaysia Plt

Life 人生 Original Chinese Calligraphy Be Yourself Etsy Chinese Calligraphy Traditional Ink Calligraphy Print

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Salary Slip Format Basic In 2022 Payroll Template Payroll Project Management Templates

We Asked Malaysians About How They Manage Day To Day Financial Responsibilities While Achieving Long Te Types Of Taxes Financial Responsibility Financial Goals

How Can I Calculate Break Even Analysis In Excel Analysis Excel Graphing

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

19 93 Vintage Japanese Kimono Jacket Tie Dye Shibori Etsy Vintage Japanese Kimono Kimono Jacket Japanese Kimono

How Can I Calculate Break Even Analysis In Excel Analysis Excel Graphing

6 Income Tax Faq 大马个人所得税需知 Income Tax Income Tax Return Online Taxes

Difference Between Direct Tax And Indirect Tax With Types Advantages And Disadvantages And Comparison Chart Key Differences

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Tax Preparation Tax Refund Tax Accountant

Joint And Separate Assessment Acca Global

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

0 Response to "types of taxes in malaysia"

Post a Comment